Key Features

-

![]() Save for Higher Education

Save for Higher Education

-

![]() Tax Advantages*

Tax Advantages*

-

![]() Competitive Interest Earnings

Competitive Interest Earnings

A Coverdell Education Savings Account (ESA) offers a way to save for a child's education — from elementary/secondary all the way up to post-graduate studies — with tax-free earnings until funds are distributed.

- ANB sets up ESA offerings as a one-year IRA

- $2,000 per year maximum contribution

- After the child is 18 years old, you can no longer make contributions to this account

- Dividends grow tax-free

- Contributions are not tax deductible

- Withdrawals are tax-free and penalty-free when used for qualified education expenses1

- To contribute to an ESA, certain income limits apply2

- Money must be withdrawn by the time beneficiary turns 303

- May be transferred without penalty to another member of the family

- Funds must be used strictly for qualified educational expenses

- There are limits on the amount that any individual can contribute for any one designated beneficiary for each year

- $25 minimum deposit to open

Learn more about Coverdell ESA accounts.

1Qualified expenses include tuition and fees, books, supplies, board, etc.

2Consult your tax advisor to determine your contribution limit.

3Those earnings are subject to income tax and a 10% penalty.

*Consult a tax advisor.

Important Information About Procedures for Opening a New Account:

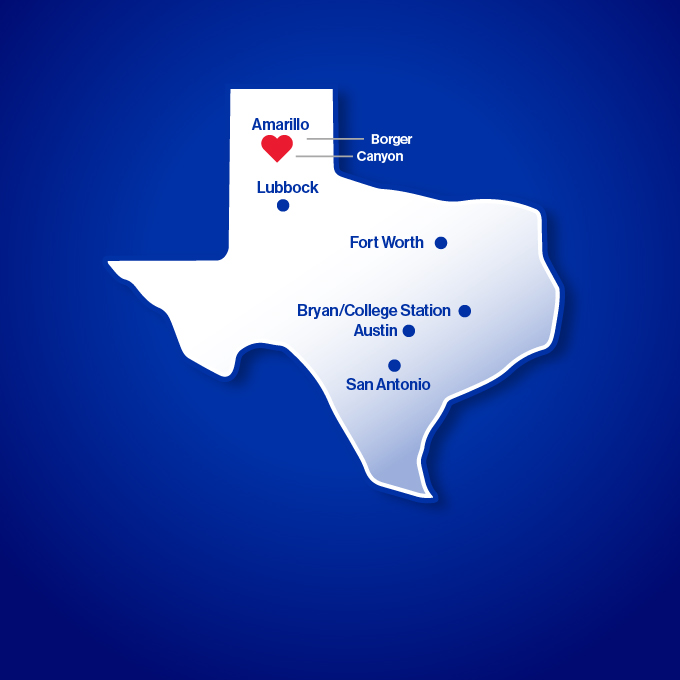

Amarillo National Bank complies with section 326 of the USA PATRIOT Act. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account such as name, address, date of birth and taxpayer identification. We may ask to see your driver's license or other identifying documents.

FDIC Insurance

NOTICE: By federal law, as of 1/1/2013, funds in a non-interest-bearing transaction account (including an IOLTA/IOLA) will no longer receive unlimited deposit insurance coverage, but will be FDIC-insured to the legal maximum of $250,000 for each ownership category. Learn more.