Key Features

-

![]() Free for ANB Customers

Free for ANB Customers

-

![]() Bank 24/7

Bank 24/7

-

![]() Download the App

Download the App

With online banking, we make it easy for you to access your accounts whenever you need them — at home, on the go, or on the other side of the world.

- Free service for ANB customers

- Manage a number of banking activities anytime, anywhere with internet access:

- Monitor your ANB accounts

- Transfer money

- Receive account messages via email or online banking alerts

- Download statements

- Save time and postage by paying bills online

- Pay your ANB loan online

- Check your CD and loan statements and balances

- Option to change your preferred language/cambiar preferencia de idioma

- Secure and easy to use

Get Started

Ready to learn the ins & outs of ANB online banking? From how-to guides to video walkthroughs, get all the information you need here.

You asked, We listened.

Account Alerts are HERE!

• Real Time Alerts

Alerts sent to you within seconds of a transaction

• Customizable Alerts

You pick the alerts and the thresholds

• Receive alerts via text or email

Your Choice!

Benefits:

- Combat Fraud

- Reduce or Avoid Fees

- Know More about your Accounts

Sign Up for Account Alerts!

Have Online or Mobile Banking?

Manage and activate alerts HERE

Don't have Online or Mobile Banking?

Visit any one of our branch locations, or call us

at (806) 378-8000 or 1-800-ANB-FREE

Account Alerts FAQ's

Ditch the paper world with online bill pay, which helps you keep your financial life green, convenient, and hassle-free. The entire process is simple and secure — and absolutely free for all ANB checking account customers.

- Pay anyone, anytime, all in one place — set up one-time or recurring payments

- Avoid the hassle of writing and mailing checks

- Get your electronic bills in bill pay from hundreds of billers

- Email alerts remind you of due dates and notify you when your payments have been sent

Use the payment calendar to display scheduled and processed payments - Make an emergency same-day payment to over 100 billers

- Ability to establish payee categories

- Stay on top of your budget and avoid late fees

Awesome Features!

-

NEW Activate Your Card - You can now activate your card without having to call the bank

-

NEW View Digital Card - Need to make an online purchase but don’t have your physical card? You can now easily view all your card information digitally

-

NEW Spend Insights – See what, when and where your purchases are happening

-

NEW Card on File - Easily determine which merchants you have your card on file with for reoccurring transactions

-

Turn Card On or Off

-

Travel Plans – Make sure your card works when you are out of town, set a travel plan

-

Set Alerts & Controls – Be alerted in real time anytime your card is used

-

Transaction Threshold – Be alerted for transactions above the limit you set

-

YOUR Cards Automatically Added

-

Set Pin - you can set your PIN number without having to visit a branch location. *This option will only be allowed for Debit Cards

Easily manage all of your ANB and LNB debit and credit cards from your mobile device! Whether you're on iPhone® or Android®, it's total control of your cards in the palm of your hand.

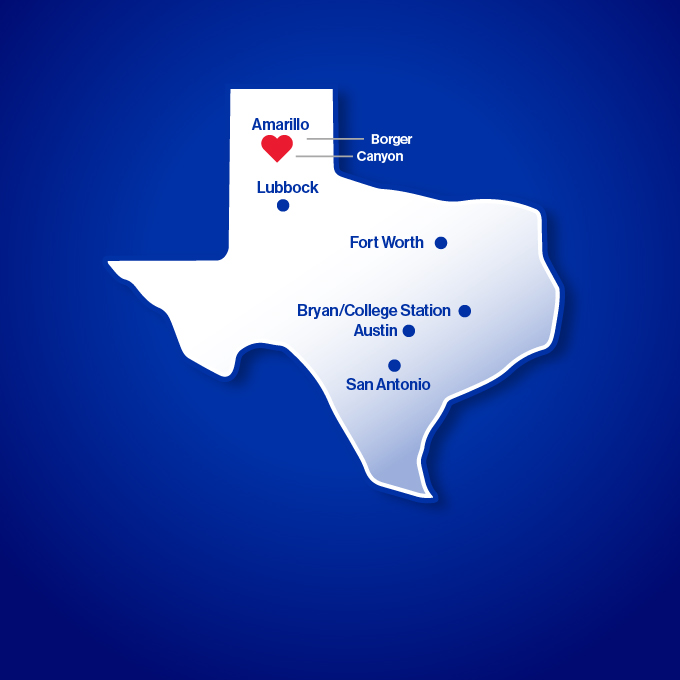

Your nearest ANB branch is right next to you. Bank on the go anytime, anywhere.

- Fast, free, and secure service for customers enrolled in online banking*

- Available to personal and business customers

- Easily keep track of your finances — even on the go:

- View account balances

- Review history

- Transfer funds between accounts

- Pay a person

- Receive alerts

- Pay bills

- Deposit checks

- Available via any web-enabled mobile device

- Use this service in these convenient ways:

- Web browsing

- App download — iPad® | iPhone® | Apple Watch® | Android™

- Save valuable time and effort; avoid an extra trip to a branch

See how to log into mobile banking (PDF).

See our mobile banking FAQ for more details.

A few helpful tips:

- The first time you log in, we will send you a special one-time access code via text or email (this is why we’ve been asking for your updated information).

- If you use our mobile app, you will need to download a new version. It will replace our old app.

- The “look” will be different. It will have a white background and a very clean appearance.

Visit us or contact us to update your contact information for mobile banking.

*Wireless carrier data rates may apply.

- Deposit checks anytime, anywhere from your mobile phone

- Free service for customers with an ANB checking account

- Save time, avoid unnecessary trips to a branch

See how to deposit a check with this PDF guide — or follow these easy instructions:

When you endorse your check for mobile deposit, please also write "For Mobile Deposit Only at Amarillo National Bank.” Then deposit your check in a few easy steps:

- Don't forget to endorse your check

- Be sure to use good lighting and place on a solid-colored surface

- Open your ANB app

- Select Menu at the top left

- Click "Deposit Check"

- Click front of check icon

- Take a picture of the front of the check

- Click "Use Image"

- Take a picture of the back of the check

- Click "Use Image"

- Click "Submit Deposit"

What does “eStatement” stand for? We like to think it stands for “e”asy access and “e”ven more secure!

They’re convenient and more safe than traditional paper statements. View your statements 24/7 by enrolling in free ANB eStatements today.

- Save paper and save the environment

- Fast, free, and easy alternative to paper statements

- Easier to retrieve info when needed

- Eliminate a paper trail

- Reduce chances of fraud and identity theft

- Arrive faster than paper statements

- Simplify recordkeeping

- Easily access past statements

- Ability to download for permanent storage or print if needed

- Receive email notice when new eStatement is ready

Enrollment is easy:

- Log into online or mobile banking

- Select “Settings”

- Select “Statement Delivery”

- Confirm or add your e-mail (you will need to repeat this step for each account)

How to view your eStatements:

- Log into online or mobile banking

- From the main menu, select “Services”

- Select “Statements”

- From there you can select your account and the desired statement to view

Upload receipts, organize them, and keep an eye on your expenses, all in one place!

How it Works:

{beginAccordion h3}

Things to Know:

- How can I access my stored receipts? Go to ReceiptTrackr under Services in Online Banking. There you can view your stored receipts.

- Where are my receipts stored? In a secure cloud-based storage.

- Can I link receipts to specific transactions? Yes! Once the transaction posts, click on Receipt Details and then click Upload.

- Can I upload a receipt to a pending transaction? You'll have to wait until it's posted, or upload it to your receipt dashboard, If you used an ANB account, the receipt will automatically link when it's posted.

- Can multiple users access the same receipts? No, only the user who uploaded the receipts can view, manage, and download them.

- Can I download or print my receipts? Yes, you can print or download files up to 10MB in formats including CSV, Excel, PDF, and Zip.

- How long are receipts kept? 7 Years

- Is ReceiptTrackr compatible with QuickBooks? Not yet! But, it’s in the works!

{endAccordion}

Goals lets you set up separate savings for each of your goals, making it easy to see how much you've saved and how much further you have to go!

-

Customizable

-

Automated savings

-

Set target dates

How to Set a Goal:

{beginAccordion h3}

Things to Know:

-

No interest for Goals: If you're looking for an interest-bearing account, learn more here!

-

Your goals are private: Only you can see your goals. Even if you have a joint account, your goals won't show up on their login. Just keep in mind that transfers you make to your goals will show up in your statements.

-

Goals are flexible: Need the money early? Just transfer it back to your checking or savings account anytime.

-

Reached your goal? That's awesome! Transfer the money to your main account and celebrate! The automatic transfers for that goal will also stop automatically.

-

Boost your savings: You can transfer money from any of your ANB accounts to your goals, or multiple ANB accounts, and set up recurring transfers to make saving automatic.

-

No debit card for Goals: Think of them as savings stashes, not spending accounts. You can easily transfer the money back to your main account to use your debit card.

{beginAccordion}