Key Features

-

![]() Wide Range of Terms

Wide Range of Terms

-

![]() Competitive Interest Earnings

Competitive Interest Earnings

-

![]() No Setup or Maintenance Fees

No Setup or Maintenance Fees

- Fixed rates, higher than standard savings

- Interest payment methods include:

- Rolling back into a CD

- Deposit to an account

- Check mailed to you (depending on length of term)

- Wide range of terms available (from 14 days to 60 months)

- Set aside for future savings goals

- No setup or maintenance fees

- $1,000 minimum deposit to open

- Funds in a CD can be withdrawn at any time, however withdrawals made before maturity are subject to a penalty (half the term's interest that would have accrued)

- At maturity, there is a 10-day grace period during which funds can be taken out or added without penalty

Important Information About Procedures for Opening a New Account:

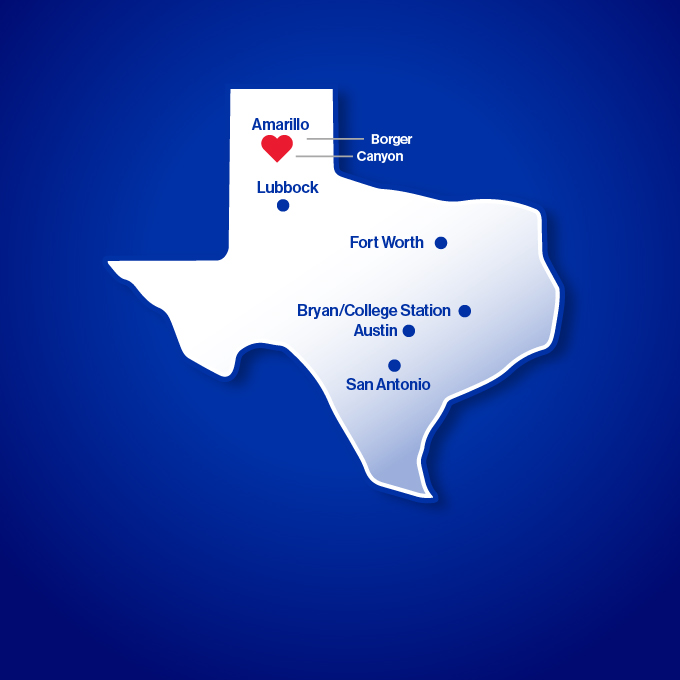

Amarillo National Bank complies with section 326 of the USA PATRIOT Act. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account such as name, address, date of birth and taxpayer identification. We may ask to see your driver's license or other identifying documents.

FDIC Insurance

NOTICE: By federal law, as of 1/1/2013, funds in a non-interest-bearing transaction account (including an IOLTA/IOLA) will no longer receive unlimited deposit insurance coverage, but will be FDIC-insured to the legal maximum of $250,000 for each ownership category. Learn more.