For most of us, credit cards can be a useful tool. However, if you're not careful, it's easy to get into a lot of trouble. ANB is here to help, with a few useful tips on:

{beginAccordion H3}

How to Build Good Credit

Pay your bills on time

Late payments will negatively affect your credit score for years.

Try to reduce your debt at every opportunity

Pay down your credit cards, car loans and mortgages when you have extra available cash (yes, car loans and mortgages are considered debt).

Budget

Make sure you have a plan that accurately reflects your monthly income and expenses. Don't charge more than 50 percent of the available line of credit on each credit card. Example: You have a $1,000 limit on your credit card. Do not charge more than $500.

Check your credit annually

You are legally entitled to dispute any incorrect or incomplete information on your file. You can do this online with any of the three major credit bureaus.

If any negative information on your credit report is accurate, the law states that it cannot be removed.

- Derogatory credit will stay on your credit report for seven years.

- Tax liens, bankruptcies and abstract judgments will stay on your credit for 10 years

How to Check Your Credit

If you've been denied for credit

The denial letter will contain instructions on how you can obtain a free credit report within 60 days from the date you received the letter.

To get a free annual credit report

- Log on to annualcreditreport.com

- Call (877) 322-8228

- Or write:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

To get a copy of your credit report at any time directly from the credit bureaus (a small fee applies):

- Equifax: (800) 685-1111 or www.equifax.com

- Experian: (888) 397-3742 or www.experian.com

- TransUnion: (800) 916-8800 or www.transunion.com

What To Do If Your Credit Needs Repairing

Work on building good credit while you wait for any negative information (assuming it's accurate) to be taken off your report.

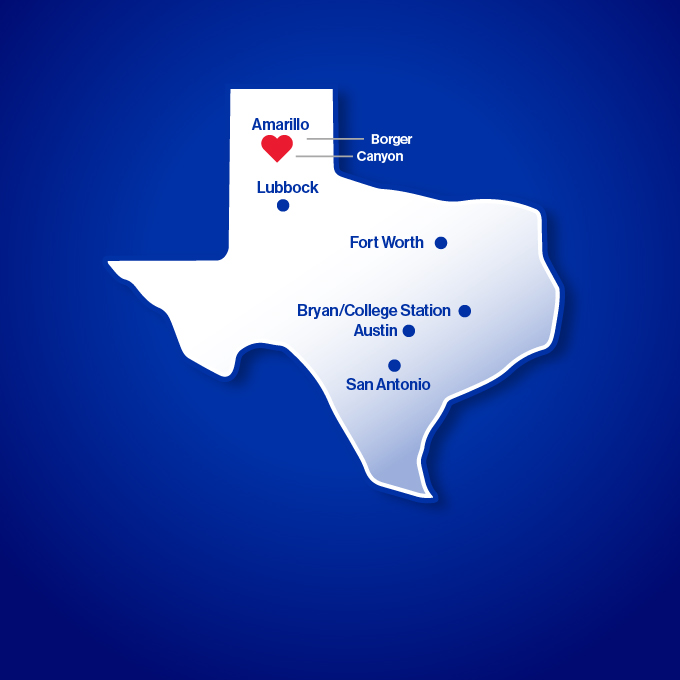

Come talk to us about your credit and lending needs. At Amarillo National Bank, we set our own underwriting guidelines and consider multiple factors in addition to your credit score. Plus, because we are a locally owned bank, all decisions are made right here in Amarillo, by people who know where you're coming from. We can often help where others can't.

{endAccordion}