Key Features

-

![]() Tax Advantages1

Tax Advantages1

-

![]() Competitive Interest Earnings

Competitive Interest Earnings

-

![]() Free Digital Banking

Free Digital Banking

- Greater personal control over healthcare management and expenses

- Prepare for qualified medical expenses

- Earn interest above standard savings on balances greater than $1,0001

- $3 monthly service fee

- An HSA provides triple tax savings:

- Tax deductions when you contribute to your account

- Tax-free earnings through investment

- Tax-free withdrawals for qualified medical, dental, vision expenses, and more2

- Contributions are tax-free and can be made by you, your employer, or a third party

- Funds can be withdrawn at any time3

- Unused funds remain in account year after year; no "use it or lose it" policy

- Keep your HSA in your name, regardless of career or life changes

- Federally insured by FDIC

- $50 minimum deposit to open

- Free HSA Visa® debit card

- Free digital banking, including:

- Online banking

- Mobile banking

- eStatements

With a Health Savings Account, you can deposit funds into an interest-bearing account, and deduct the contributions on your tax return. There is no deadline for when you have to spend the money. You can roll over the funds each year and use them when you need them.

You can save for medical expenses with an HSA.

With this account, you can make tax deductible contributions and use the funds to pay for medical expenses for you, your spouse and your dependents. Covered medical expenses include prescriptions, doctor visits, dental and vision expenses.

To qualify for an HSA, you:

- Must be covered by a High Deductible Health Plan (HDHP)

- You cannot be covered by any other type of insurance

- Cannot be claimed as a dependent on another person's tax return

- Cannot be enrolled in Medicare

|

Year |

2024 |

2025 |

|---|---|---|

|

Contribution limit for self-only coverage |

$4,150* |

$4,300* |

|

Contribution limit for family coverage |

$8,300* |

$8,550* |

|

HDHP Maximum Out-of-Pocket limit for self-only coverage |

$8,050 |

$8,300 |

|

HDHP Maximum Out-of-Pocket limit for family coverage |

$16,100 |

$16,600 |

|

HDHP Minimum Deductible amount for self-only coverage |

$1,600 |

$1,650 |

|

HDHP Minimum Deductible amount for family coverage |

$3,200 |

$3,300 |

*Plus $1,000 maximum catch-up for individuals turning age 55 or older HDHP and contribution limitations are revised each year to reflect cost-of-living increases.

In addition to the standard HSA contribution limits shown in the previous table, if you have reached the age 55 before the close of a taxable year, you may also contribute an additional amount known as a "catch-up" contribution.

If HSA funds are used for any purpose other than a qualified medical expense, those funds are taxable, and will be penalized an additional 20 percent. The card also may not be used for cash withdrawals at the ATM.

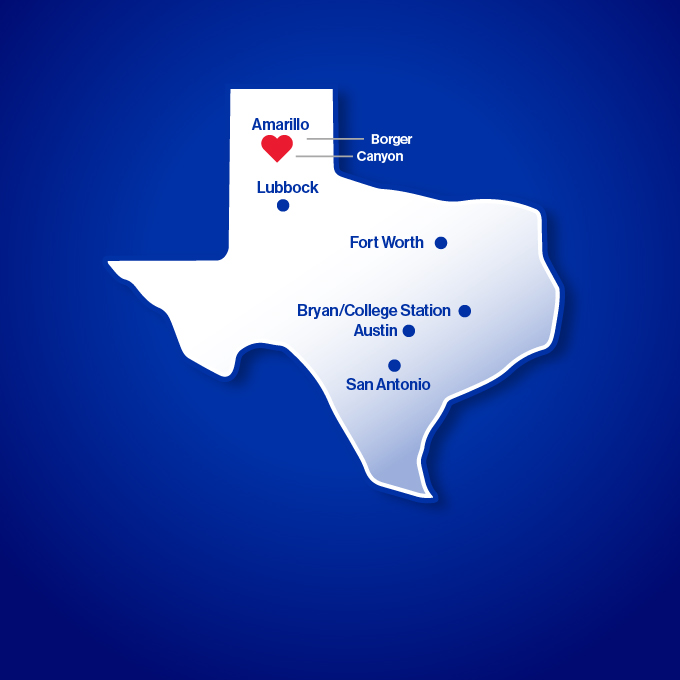

Contact our HSA Administrator for additional information: Shana Wilhite 806-378-8108 [email protected]

1The interest rate and annual percentage yield may change. At our discretion, we may change the interest rate on the account daily. Interest begins to accrue no later than the business day we receive credit for the deposit of noncash items (for example, checks). Interest will be compounded monthly and will be credited to the account monthly on the daily collected balance. If the account is closed before the interest is credited, you will receive the accrued interest.

2Consult a tax advisor.

3You can withdraw funds at any time for any purpose. However, if funds are withdrawn for reasons other than qualified medical expenses, the amount withdrawn will be included as taxable income, and is subject to a 20% penalty.

Important Information About Procedures for Opening a New Account:

Amarillo National Bank complies with section 326 of the USA PATRIOT Act. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account such as name, address, date of birth and taxpayer identification. We may ask to see your driver's license or other identifying documents.

FDIC Insurance

NOTICE: By federal law, as of 1/1/2013, funds in a non-interest-bearing transaction account (including an IOLTA/IOLA) will no longer receive unlimited deposit insurance coverage, but will be FDIC-insured to the legal maximum of $250,000 for each ownership category. Learn more.