April 2025

Amarillo's economy slowed down a little bit in April due to tariff uncertainty and higher interest rates.

Retail Sales for the month are down 3% from 12 months ago. Year to Date Sales are up 2.6%. New Car Sales are down 3% and Used Car Sales are up 4%. Area Car Dealers are worried what tariff confusion will do to them with the factories and their customers; and used prices are starting to move up.

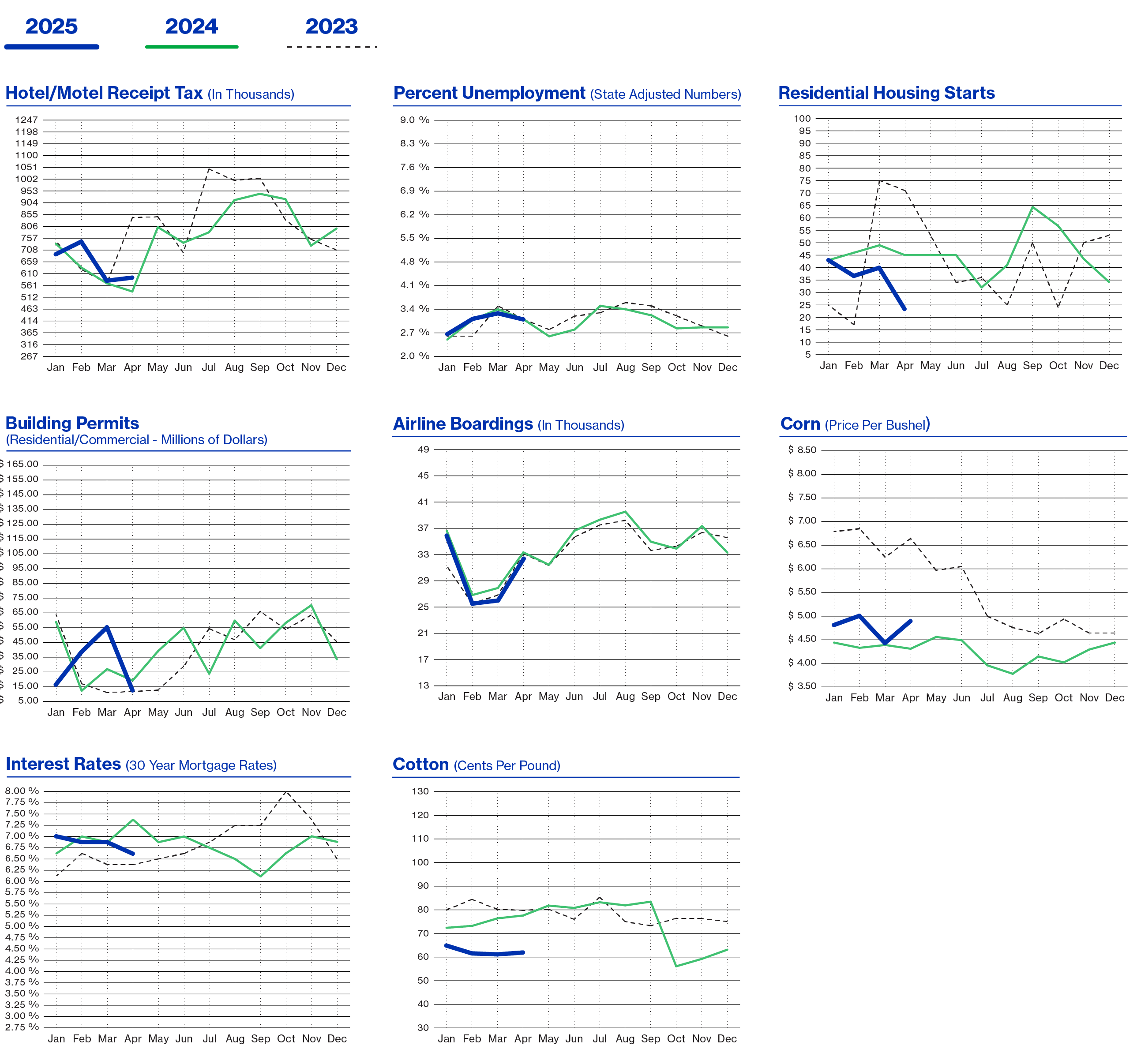

Tourism is in flux. The Amarillo bed tax is up 12%, but this is due to audits of hotels causing spikes from back taxes. Hotel revenue in March was down 3%, with occupancy down 5% from a year ago. Airline Boardings were down 5%, but this is better than the 11% drop nationwide. As travelers become more budget conscious, our auto travel may increase more than the loss of airline travel, resulting in this summer being positive to slightly up for Amarillo.

There are 2,600 more people working in Amarillo in the Household Survey, (which includes part time workers). The Employer's Survey shows an increase of 1,700. Wages are up 4% from 12 months ago.

Construction has slowed. Mortgage Rates are all over the place, with the movement in the 10-Year Treasury. There were 50% less Housing Starts this month compared to last April. Year to Date Starts are down 31%.Overall, building permits are down 34% YTD.

Amarillo's Economic Development Corporation has been the best in the state over the past 30 years. Recently some local politicians have attacked this vital engine of Amarillo's success, unsettling future growth.

Drilling activity is still slow in the Panhandle, with only 1 rig operating. Natural Gas prices are up 83% from last year, but Oil Prices are down 27%.

Moisture has helped agriculture. Wheat prices are up 10% and corn up 11% from last year. Tariff uncertainty has pushed cotton down 19%.

The Cattle Market continues to surprise. Prices are up 11% from a year ago to over $2.00. High demand and good margins have helped. It will be very hard to price in profits from where the market sits today.

Milk prices are up 7% from last April to $17.75, but down from last month.

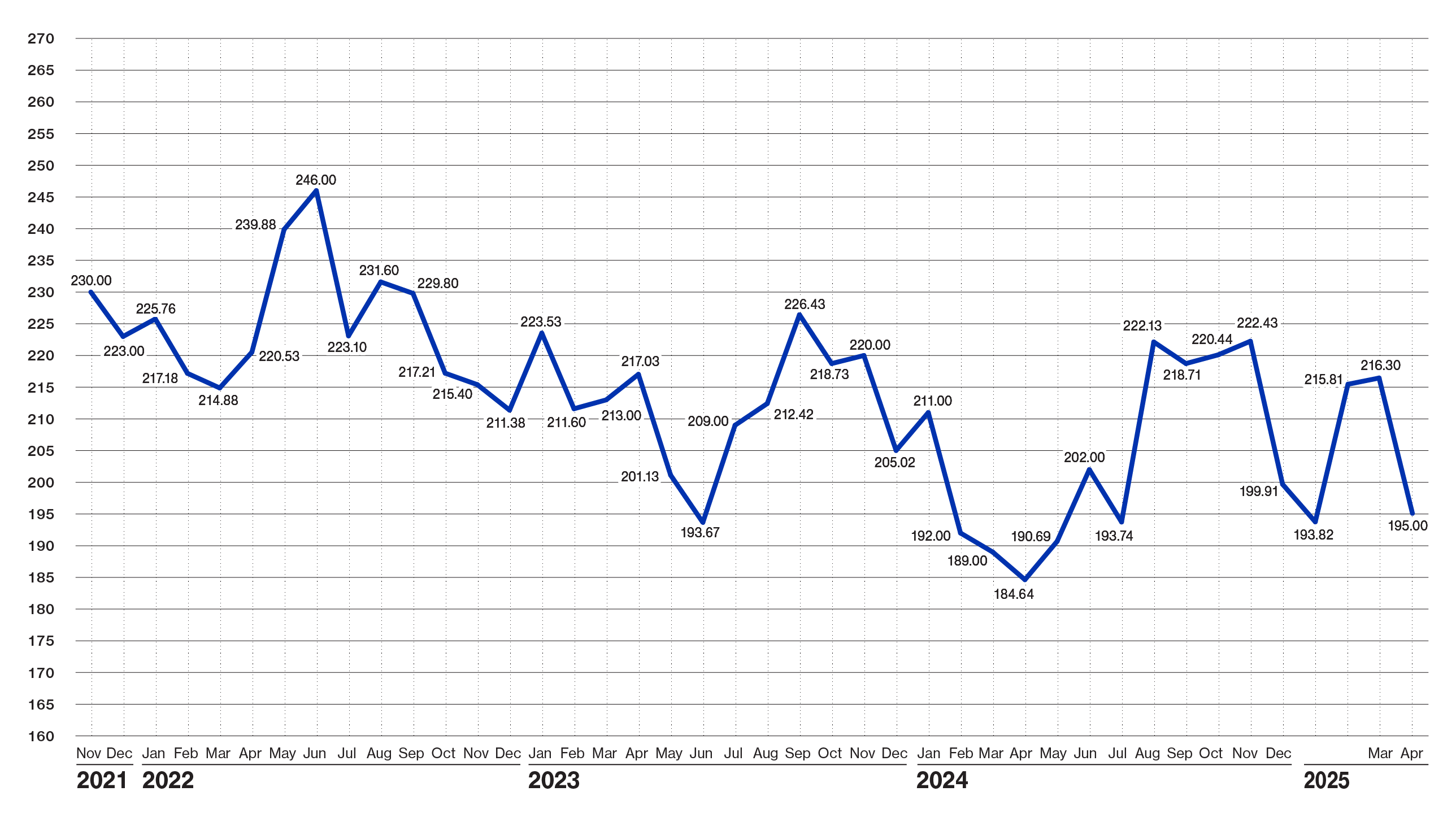

Economic Pulse

| Economic Components | Current Month | Last Month | Last Year |

|---|---|---|---|

| Index (Base Jan. 88 @ 100) | 195.00 | 216.30 | 184.64 |

| Sales Tax Collections | $ 7,161,594 | $ 7,435,512 | $ 7,382,109 |

| Sales Tax Collection-YTD | $ 34,388,953 | $ 27,227,358 | $ 33,520,764 |

| New Vehicle Sales | 636 | 656 | 655 |

| Used Vehicle Sales | 1,683 | 1,511 | 1,615 |

| Airline Boardings | 31,720 | 26,522 | 33,335 |

| Hotel/Motel Receipt Tax | $ 602,238 | $ 578,127 | $ 536,089 |

| Population - Corporate Amarillo | 201,106 | 201,106 | 201,106 |

| Employment - CLF | 140,247 | 140,752 | 137,532 |

| Unemployment Rate | % 3.10 | % 3.30 | % 3.10 |

| Total Workers Employed (Household Survey) | 135,928 | 136,089 | 133,325 |

| Total Workers Employed (Employers Survey) | 130,600 | 130,600 | 128,902 |

| Average Weekly Wages | $ 1,071.00 | $ 1,071.00 | $ 1,030.00 |

| Gas Meters | 70,200 | 70,210 | 70,233 |

| Interest Rates: 30 Year Mortgage Rates | % 6.625 | % 6.875 | % 7.375 |

| Building Permits Dollar Amount | $ 12,751,988 | $ 55,151,370 | $ 19,221,287 |

| Year to Date Permits | $ 108,061,608 | $ 95,161,031 | $ 60,486,198 |

| Residential Starts | 23 | 40 | 45 |

| Year To Date Starts | 100 | 77 | 145 |

| Median House Sold Price | $ 255,000 | $ 242,120 | $ 245,000 |

| Drilling Rigs In Panhandle | 1 | 1 | 3 |

| Oil Price Per Barrel | $ 62.79 | $ 67.61 | $ 85.54 |

| Natural Gas | $ 3.25 | $ 3.99 | $ 1.77 |

| Wheat Per Bushel | $ 6.46 | $ 6.61 | $ 5.89 |

| Fed Cattle Per CWT | $ 206.40 | $ 199.00 | $ 186.36 |

| Corn Per Bushel | $ 4.81 | $ 4.43 | $ 4.31 |

| Cotton (Cents Per Pound) | $ 62.70 | $ 61.90 | $ 77.60 |

| Milk | $ 17.75 | $ 18.45 | $ 16.50 |

Heads up, it’s time for the legal spiel!

This document was prepared by Amarillo National Bank on behalf of itself for distribution in Amarillo, Texas and is provided for informational purposes only. The information, opinions, estimates and forecasts contained herein relate to specific dates and are subject to change without notice due to market and other fluctuations. The information, opinions, estimates and forecasts contained in this document have been gathered or obtained from public sources believed to be accurate, complete and/or correct. The information and observations contained herein are solely statements of opinion and not statements of fact or recommendations to purchase, sell or make any other investment decisions.

Economic Pulse Charts

{beginAccordion h3}

2025 Economic Analysis

{endAccordion}

{beginAccordion h3}

2024 Economic Analysis

{endAccordion}

{beginAccordion h3}

2023 Economic Analysis

{endAccordion}